1031 tax deferred exchange meaning

That would allow for the. Here are some additional details regarding the forward.

Irs 1031 Exchange Rules For 2022 Everything You Need To Know

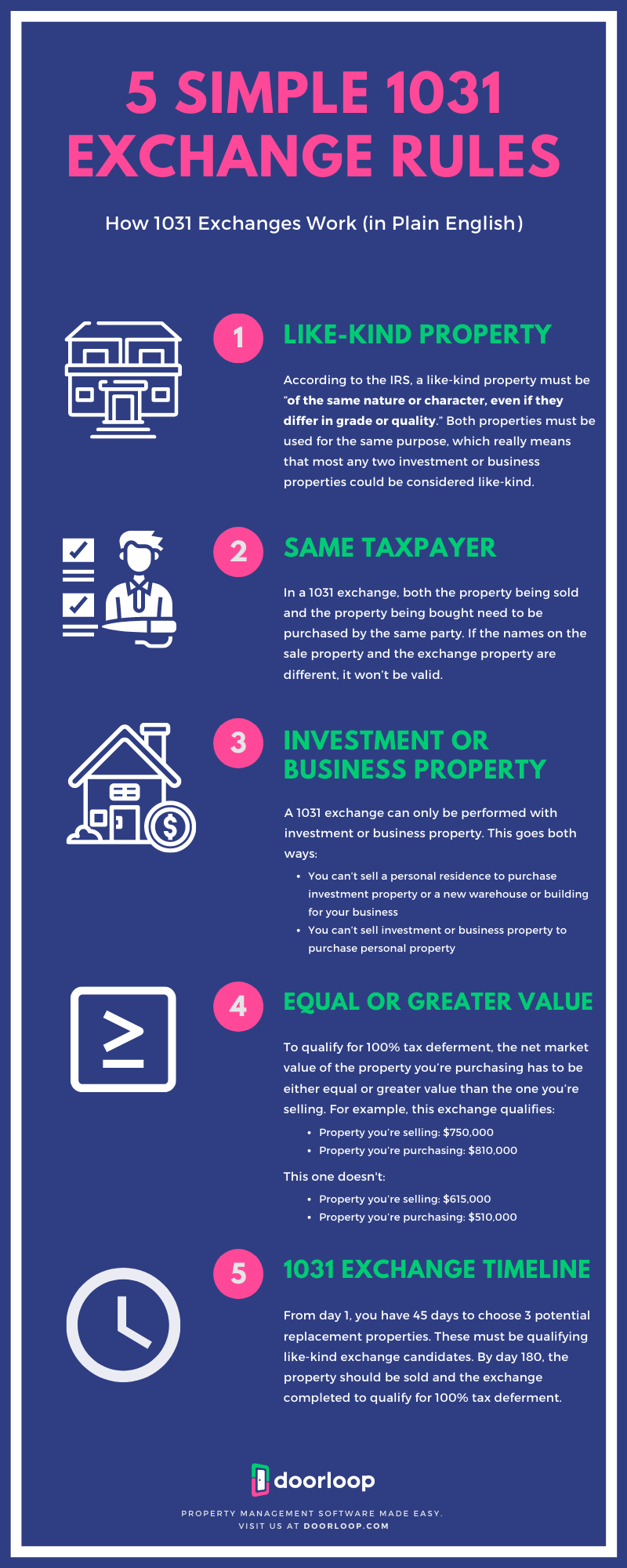

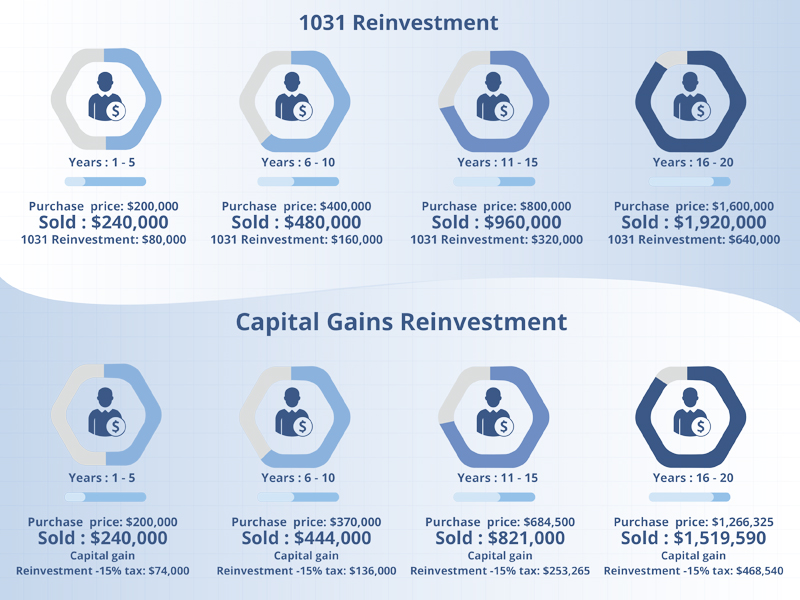

A 1031 exchange allows you to defer capital gains tax thus freeing more capital for investment in the replacement property.

. A 1031 exchange allows real estate investors to sell one property and roll those proceeds into a like-kind replacement asset. If your long-term capital gains tax rate is 20 that means youd owe 60000 on the sale of that property. A 1031 exchange is similar to a traditional IRA or 401k retirement plan.

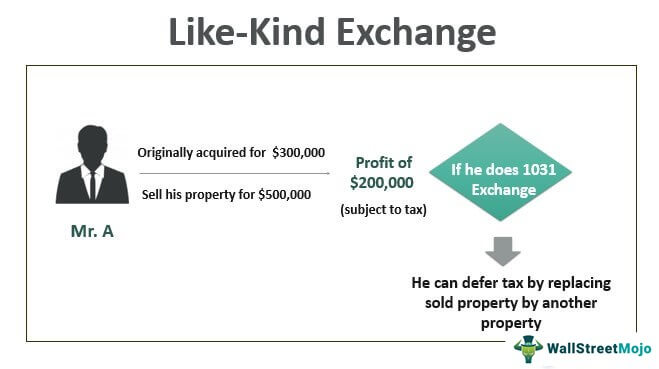

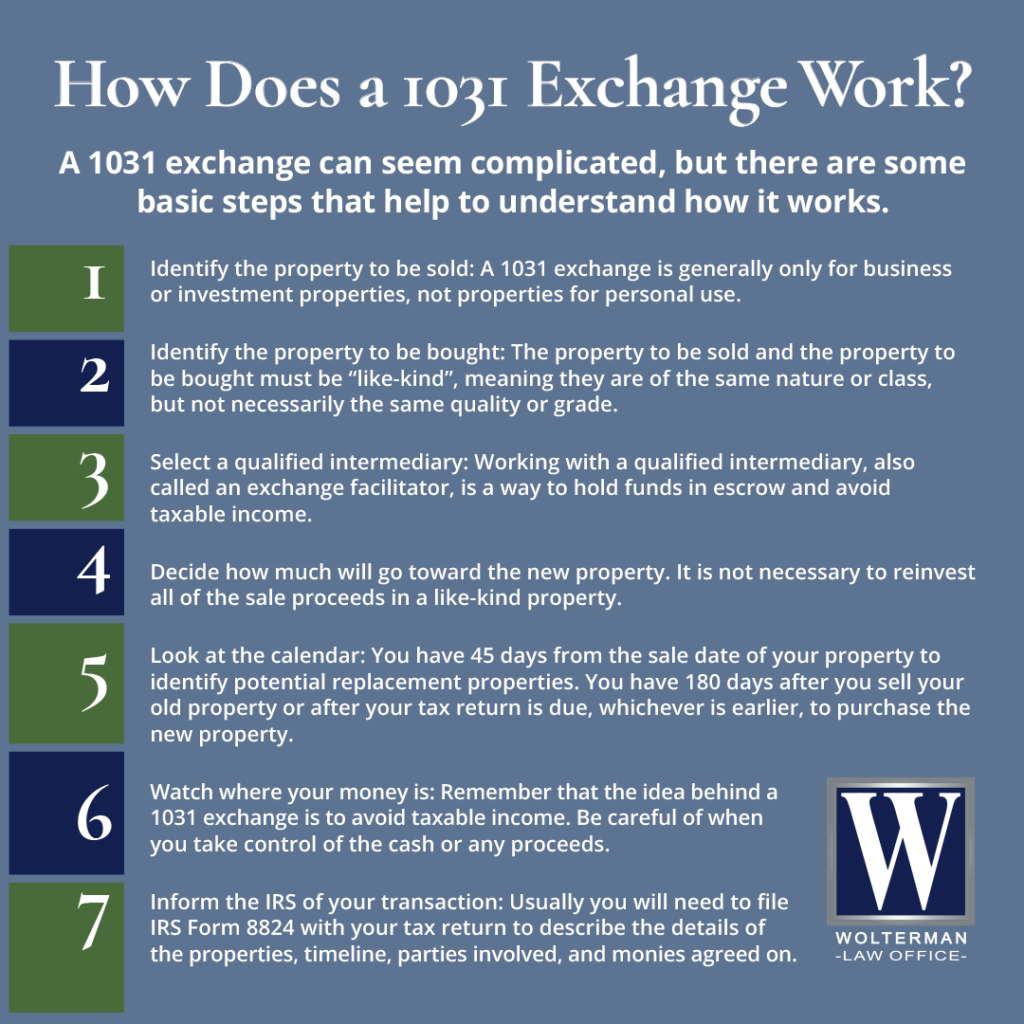

The tax deferred exchange as defined in 1031 of the Internal Revenue Code offers taxpayers one of the last great opportunities to build wealth and save. The 1031 exchange is in effect a tax deferral methodology whereby an investor sells one or several. Section 1031 of the Internal Revenue Code provides that no gain or loss shall be recognized on the exchange of property held for productive use in a trade or business or for.

1031 Tax-Deferred Exchange Definition. The purpose of real estate investors does 1031 tax exchange is to defer payment of capital gains taxes from real estate transactions. For real estate investors 1031 exchanges create an opportunity for investors to move from one property to another and provide tax benefits for.

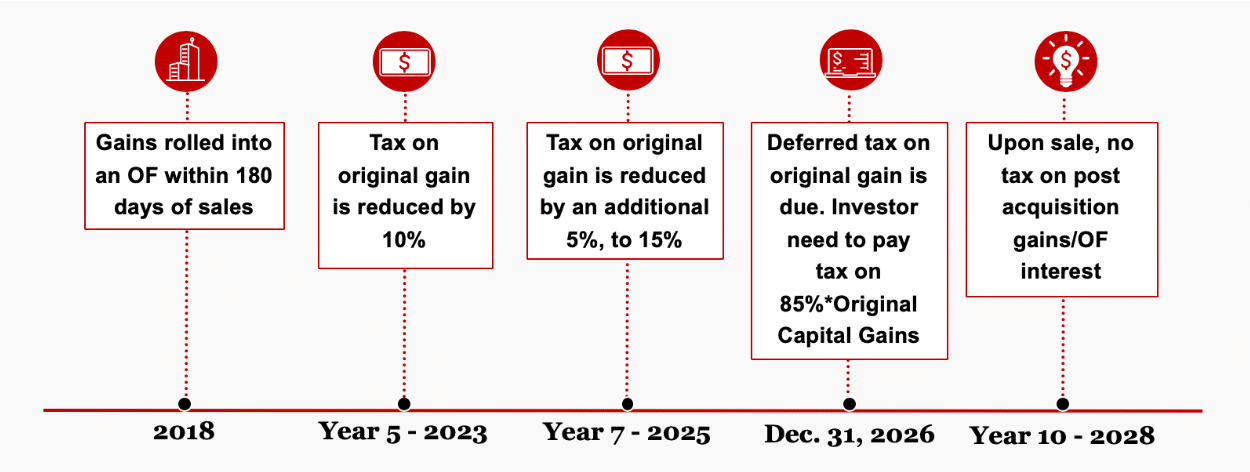

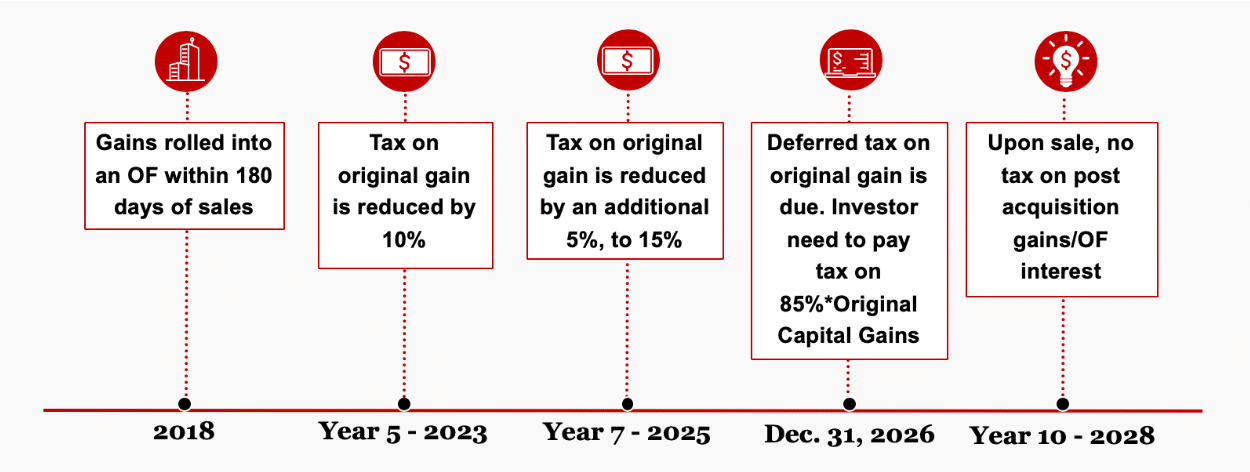

By doing this investors can defer tax liabilities. 1031 Tax-Deferred Exchange Timeline To qualify as a 1031 exchange you must normally identify the replacement property within 45 days of the sale of the relinquished. The exchange can include like-kind.

What does tax deferred exchange mean. The 1031 tax-deferred exchange is a method of temporarily avoiding capital gains taxes on the sale of an investment or business. Gain deferred in a like-kind exchange under IRC Section 1031 is tax-deferred but it is not tax-free.

A 1031 forward exchange means the seller has relinquished or sold one property before purchasing another. Its important to keep in mind though that a 1031 exchange may. When a real estate investor sells a.

Pretend you dont already qualify for the primary residence capital gains exemption too. A 1031 exchange is similar to a traditional IRA or 401k retirement plan. The 1031 tax-deferred exchange is a method of temporarily avoiding capital gains taxes on the sale of an investment or business property.

The exchange allows for the. When someone sells assets in tax-deferred retirement plans the capital gains that would otherwise be taxable are. What Does Tax Deferred Mean.

Those taxes could run as high. Under Section 1031 of the IRS Code some or all of the realized gain from the exchange of one property for a like kind property may be deferred. The Tax Deferred Exchange.

If that same investor used a 1031 tax deferred exchange with the same 25 down payment and 75 loan-to-value ratio they could reinvest the entire 200000. As part of a qualifying like-kind exchange. For example if you purchase a property for 300000 and.

The tax deferred exchange as defined in 1031 of the Internal Revenue Code offers taxpayers one of. Top 10 Reasons Real Estate Investors Are Jumping into DSTs. By doing a 1031 exchange youre kicking that tax obligation down the line and can access your.

Tax deferral is a tax-strategy that pushes out the due date on taxes for gains on an investment. The 1031 tax-deferred exchange is a method of temporarily avoiding capital gains taxes on the sale of an investment or business property. It is not a tax-free event.

Thanks to the 1031 exchange you can reinvest the profits into.

What Is A 1031 Exchange Asset Preservation Inc

Real Estate Glossary Real Estate Terminology Real Estate Real Estate Articles Real Estate Agent

Options To Reduce Tax On Sale Of Real Estate Used In A Business Rdg Partners

What Is A 1031 Tax Deferred Exchange Kiplinger

12 Situations For Using A Tax Deferred 1031 Exchange Feelings Generation Memories

Everything You Need To Know About 1031 Exchange Rules Kw Utah Kw Utah

Like Kind Exchanges Of Real Property Journal Of Accountancy

1031 Tax Deferred Exchange Explained Ligris

Financing Archives Norada Real Estate Investments

Drop And Swap 1031 Exchange A Guide For Real Estate Investors

What Is A 1031 Exchange Dst How Does It Work And What Are The Rules

What Is A 1031 Exchange Properties Paradise Blog

Like Kind Exchange Meaning Rules How Does 1031 Works

All About 1031 Tax Deferred Exchanges Real Estate Investment Tips Youtube

Are You Eligible For A 1031 Exchange

1031 Exchange When Selling A Business

1031 Exchange Services Ohio Business And Tax Lawyers

The Final Walk Through Explained For Nyc Nyc Finals Explained

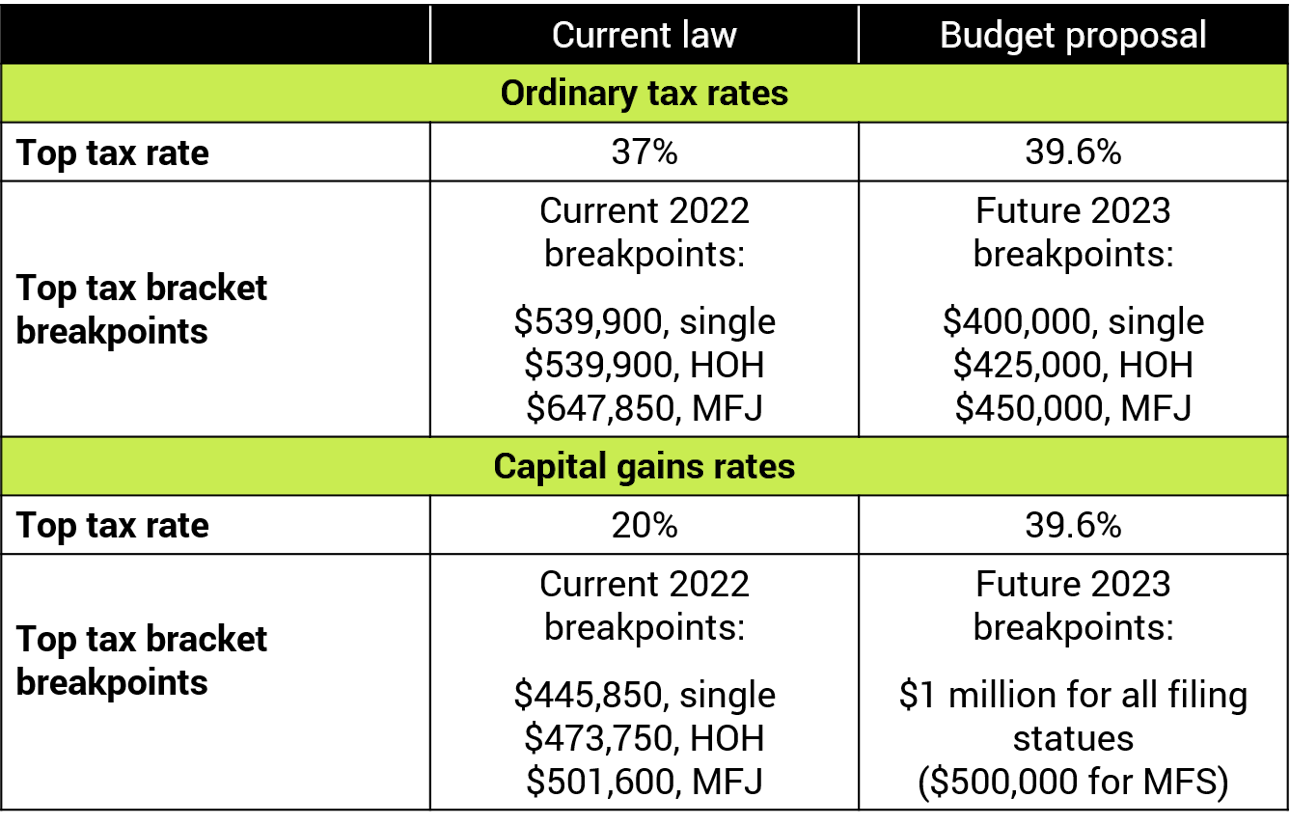

President Biden Proposes Tax Changes In Fy 2023 Budget Baker Tilly